More Risk, Less Reward? Over $10million Invested With State Bank of India (BBB-) #200.1

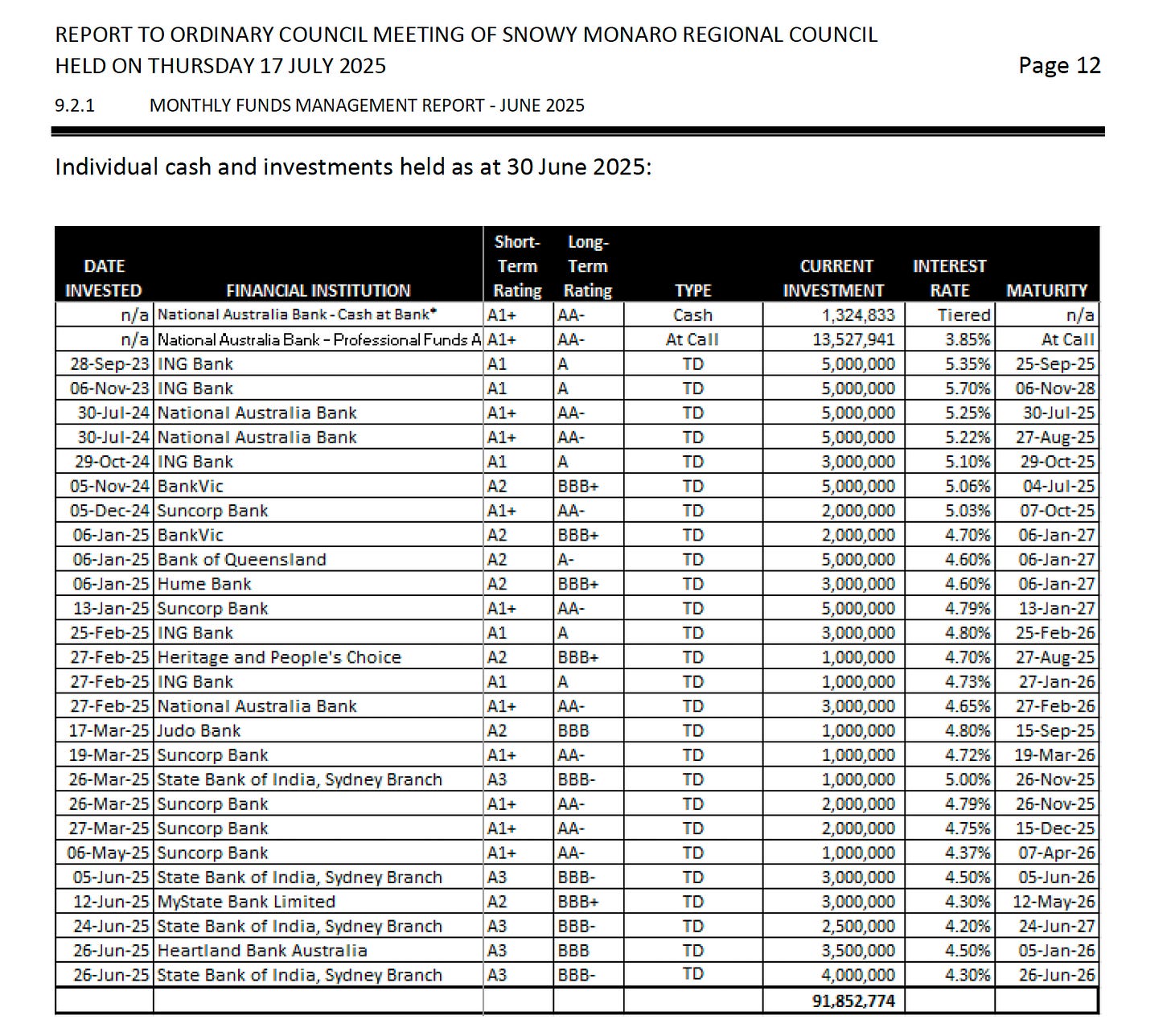

At the July Snowy Monaro Regional Council meeting, Councillor Rose raised concerns about the Council's investment strategy—specifically questioning why over $10 million of ratepayer funds had been allocated to the State Bank of India, an institution with the lowest permissible credit rating of BBB-.

As Councillor Rose pointed out, the returns offered by the State Bank of India are comparable—or in some cases inferior—to those offered by significantly higher-rated institutions such as ING (rated A).

This raises legitimate questions about whether Council is exposing ratepayer funds to unnecessary risk without corresponding reward. While the Chief Strategy Officer confirmed that the investment falls within policy limits, the lack of a clear rationale at the meeting for choosing a lower-rated institution over safer alternatives suggests a deeper review of the policy’s application may be warranted. At its core, the issue is simple:

Are we taking on more risk for less return?

#SnowyMonaro #SMRC #CoomaCouncil #MonaroZone #RegionalNSW #RatepayerFunds #PublicMoney #CouncilSpending #InvestmentTransparency #FinancialAccountability #RiskVsReward #CouncilOversight #LocalGovernmentMatters #CouncillorRose #CommunityFirst #DemandTransparency #CouncilWatch #HoldThemAccountable #PublicInterest #WatchThis #YouNeedToKnow #DidYouKnow #LocalNews #CivicDuty #ExposeTheTruth

Rawlings answers. Hmmmm …

Bank of India - over $10million. Are you kidding me ?

That just does not make any sense at all.

Oh My Goodness me comes to mind.

No wonder none of the Gang want an Audit - but we truly are about transparency and accountability.

Yeh right.

Yeh, we are - truly.

Then put your money in the Bank of India. Not the ratepayers.

I’d say watch that space !

Snouts in the trough ?

Brown paper bags ?

What u talking about ? No apologies needed …

Crickets ?

Popcorn anyone ?

A Very Concerned Ratepayer.

I believe in diversification in investment but $A10m with the State Bank of India? Hmm. A forensic audit is required, as is information about the investment strategy.